Help Lightning Blog

Results Of The 2021 Field Service Industry Sentiment Study

Analysis of the results of Blumberg Advisory Group’s inaugural Field Service Industry Sentiment Study provides an interesting perspective on the current and future direction of the industry post-Covid 19. Learn how field service software and many other industry questions are viewed by company leaders in this study completed by Michael Blumberg and sponsored by Help Lightning.

Key Findings In This Inaugural Study Include:

- Field Service Industry participants have a bullish outlook on the future of their service business and the industry as a whole.

- Many FSOs plan to hire additional field service engineers in the next 12 months but have skepticism about their ability to find qualified candidates.

- A significant percentage of FSOs indicate that their service business is in hyper growth mode and transforming their companies.

- Field service leaders view AR-enabled software as an effective alternative to delivering onsite service during the pandemic. And a significant number (31%) believe it has become an essential tool for providing field service ongoing.

These insights should provide valuable data to field service organizations. Especially in guiding their business plans and decisions over the next 12-18 months.

You can download and read the entire sentiment study today.

Study Background

In June of this year (2021), Blumberg Advisory Group launched its inaugural Field Service Industry Sentiment Study. Sponsored by Help Lightning, a leading provider of Remote Visual Assistance Software, the objective of this study was to assess the current sentiment in the Field Service industry on a variety of topics such as new and emerging technologies, hiring practices, and workforce structure. The study findings provide field service industry decision makers with valuable insight and perspectives. This includes planning future investments in their field service business.

The study methodology involved an online survey targeted to a cross representative sample of field service industry leaders from various demographic segments and cohort groups.

Study Demographics

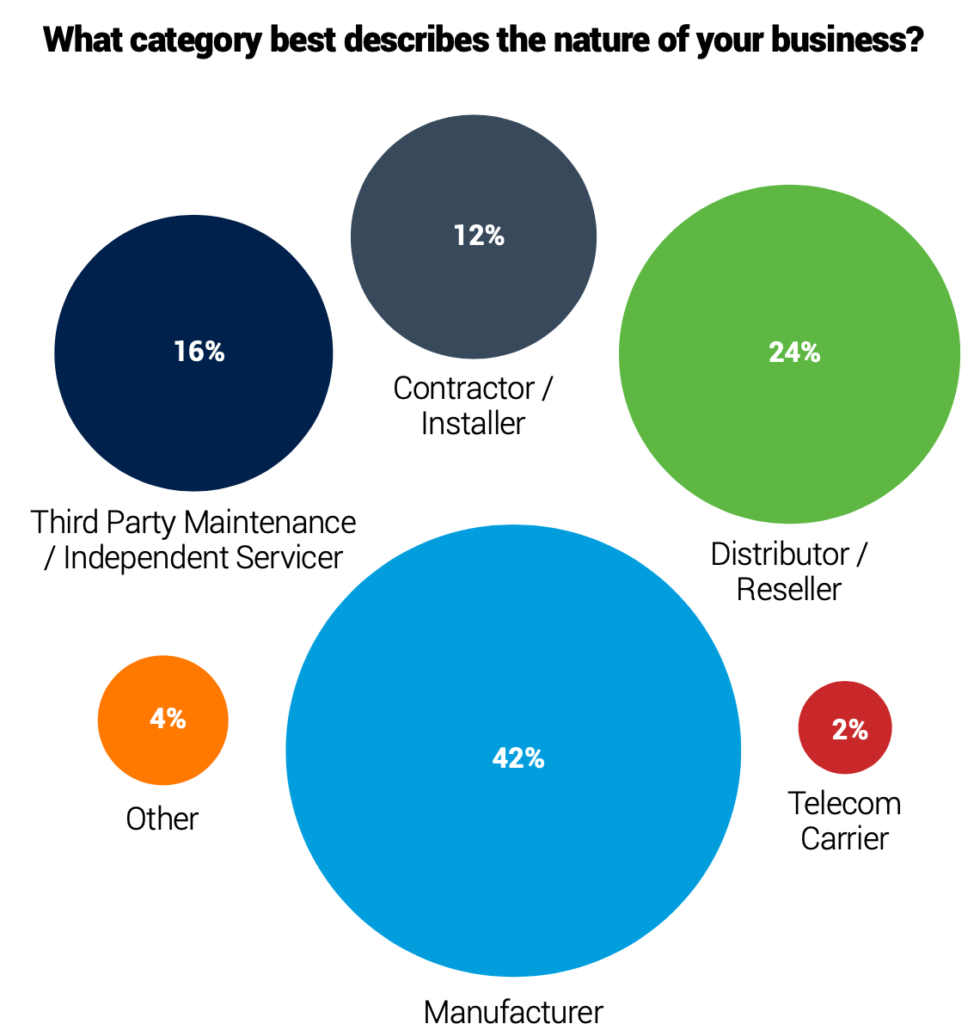

The study includes the views of 130 field service leaders from different types of businesses. Slightly more than 40% of these businesses are representative of Manufacturers. One-quarter represent channel partners of manufacturers (i.e., distributors, resellers, etc.) Third-Party Maintainers (TPMs)/Independent Service Organizations (ISOs) accounted for 16%. Contractors/Installers and Telecom Carriers accounted for the rest.

The survey included a cross-section of respondents regarding their role in their company. It also included the number of field service workers (e.g. technicians, engineers, plumbers, mechanics, etc.) they employ (see figure 2). Respondent roles included board members, president/owners, vice presidents, C-Level executives, and managers/supervisors. The most significant number of respondents (28%) were from companies that managed 101 to 250 field service workers, followed by 51 to 100 (25%), 251 to 500 (17%), and 501 to 999 (10%). Their companies employ less than 50 field service workers (10%) to more than 1,000 (11%).

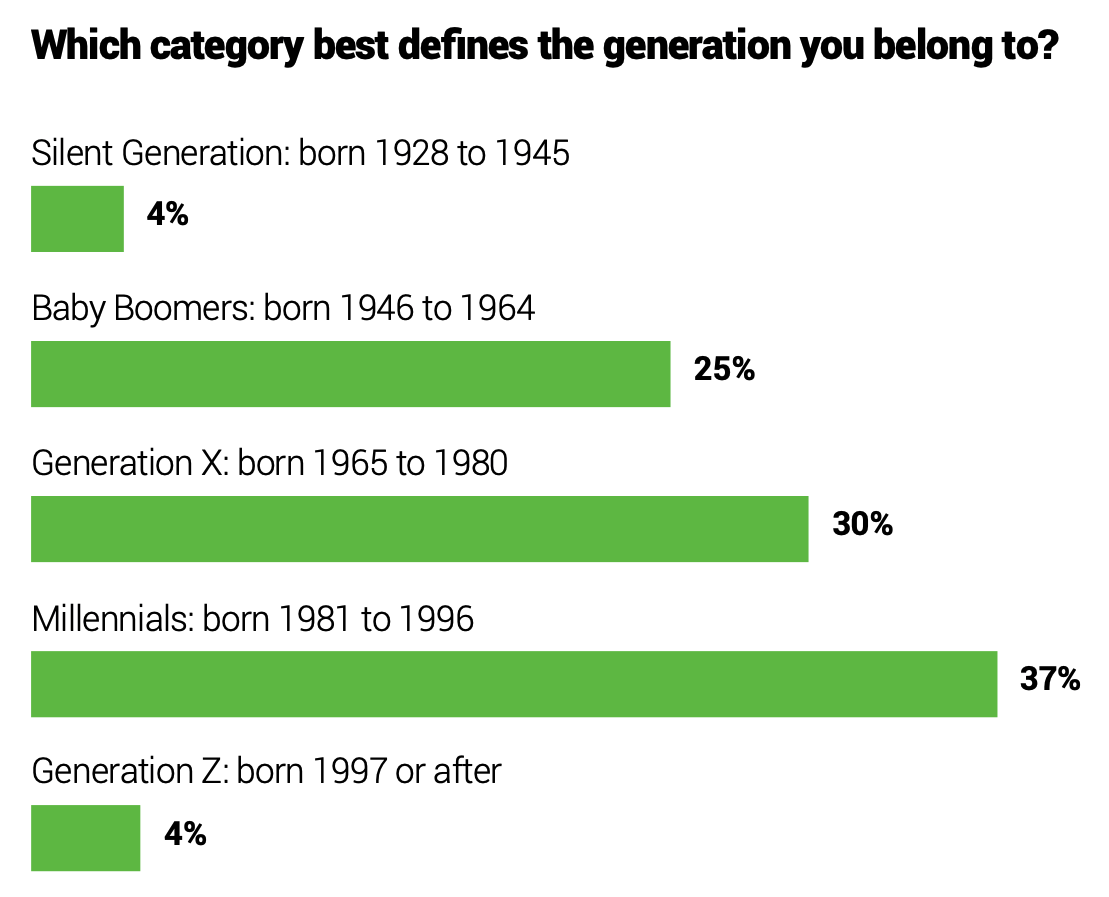

When designing the study methodology, the focus was on how opinions or sentiments about the Field Service Industry differ by generation. A plurality (37%) of respondents are Millennials. Generation X accounts for 30% of the survey population, while the Baby Boomer generation represents one-quarter of the respondents surveyed. Generation Z and the Silent Generation each account for 4% of respondents.

Select Study Findings: The Role Of Field Service Software

Covid-19 and the Recovery

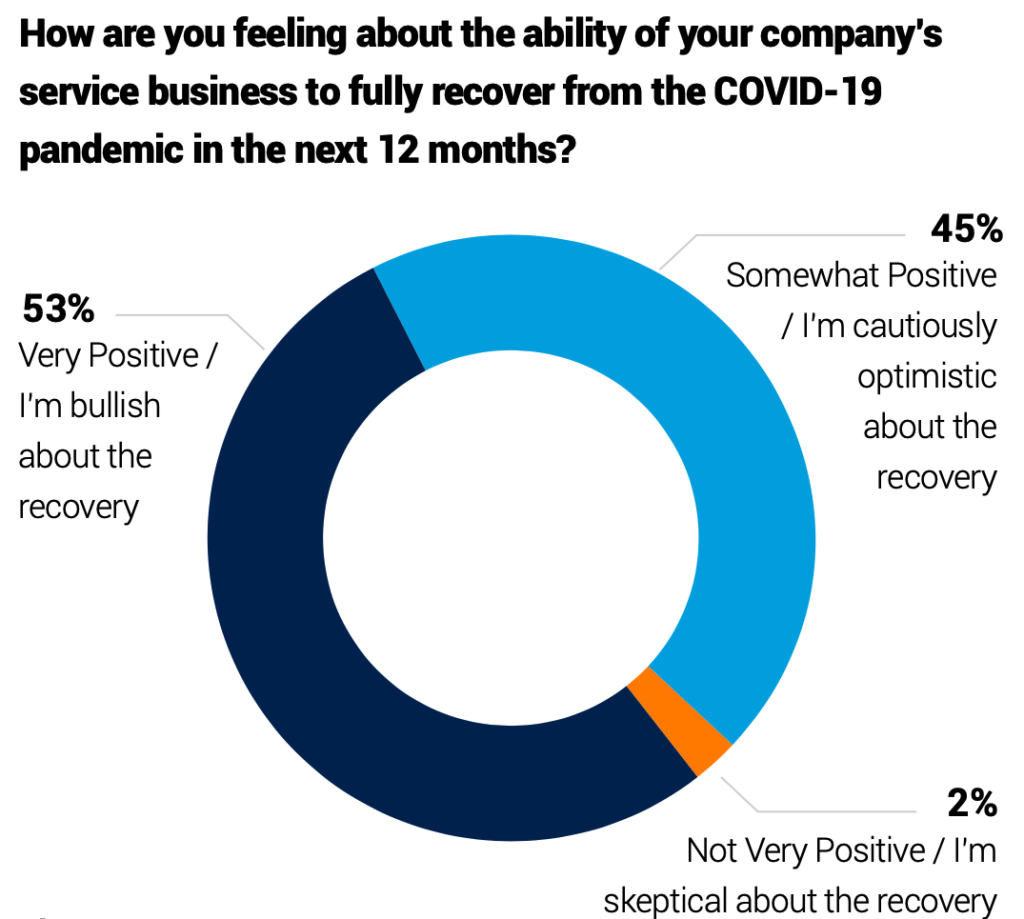

Hopes of a speedy business recovery from the Covid-19 pandemic are a pressing issue on most people’s minds. Fortunately, over half (53%) of survey respondents are bullish on the ability of their companies to fully recover from the Covid-19 pandemic in the next 12 months. Another 45% are cautiously optimistic. A small percentage (2%) are skeptical Baby Boomers. They are significantly more confident about the ability of their companies to recover than Generation X and Millennials by a factor of 2.3 to 1 and 1.4 to 1, respectively. Interestingly, most Generation Xers are cautiously optimistic, while most Baby Boomers (75%) and Millennials (55%) are bullish.

These perspectives track the values and experiences of each of these different cohort groups closely. For example, Baby Boomers have a strong work ethic, are self-reliant and competitive. While Generation X is adaptable and independent, they are also skeptical and pragmatic about embracing the future. In contrast to Millennials, who are typically enthusiastic and eager.

Differences By Business Type

The study identified differences by business type. Manufacturers (73%) were the most bullish on the prospect of their companies to recover in the next 12 months. This is compared to a smaller percentage of Distributors/ Resellers (48%), Contractors/Installers (29%), and TPMs/ ISOs (28%) who are bullish. A more significant percentage of respondents within these last three (3) cohort groups are cautiously optimistic about the prospects for their companies.

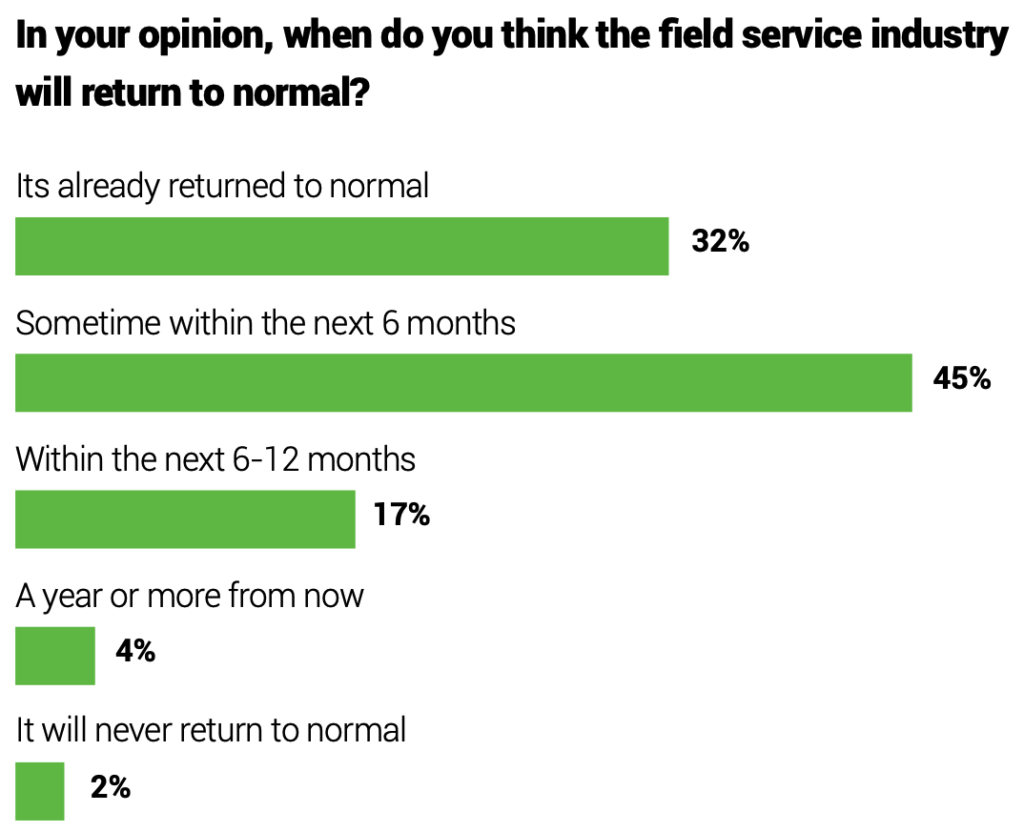

It’s encouraging that most respondents are bullish or optimistic about the future of their businesses. Nearly one- third (32%) of the respondents believe that the Field Service Industry has already returned to normal.

Almost half of the respondents (45%) believe the industry will return to normal in the next six months. Only 17% believe the industry will return to normal in the next 6-12 months. And 4% think it will be a year or more from now. A small percentage (2%) believe it will never return to normal. This aligns with the percentage of respondents skeptical about their businesses’ ability to recover.

Consistent Findings For Field Service Organizations

These findings did not present a big surprise. They are consistent with observations and in-depth conversations with industry participants. It’s also reasonable to expect businesses to be optimistic given the increase

in vaccination rates, decrease in Covid-19, easing of restrictions, and opening of the economy in many regions of the world. We anticipate that field service organizations will implement more aggressive growth strategies and make significant investments in their businesses and new technologies due to this future outlook.

Field Service Industry Outlook

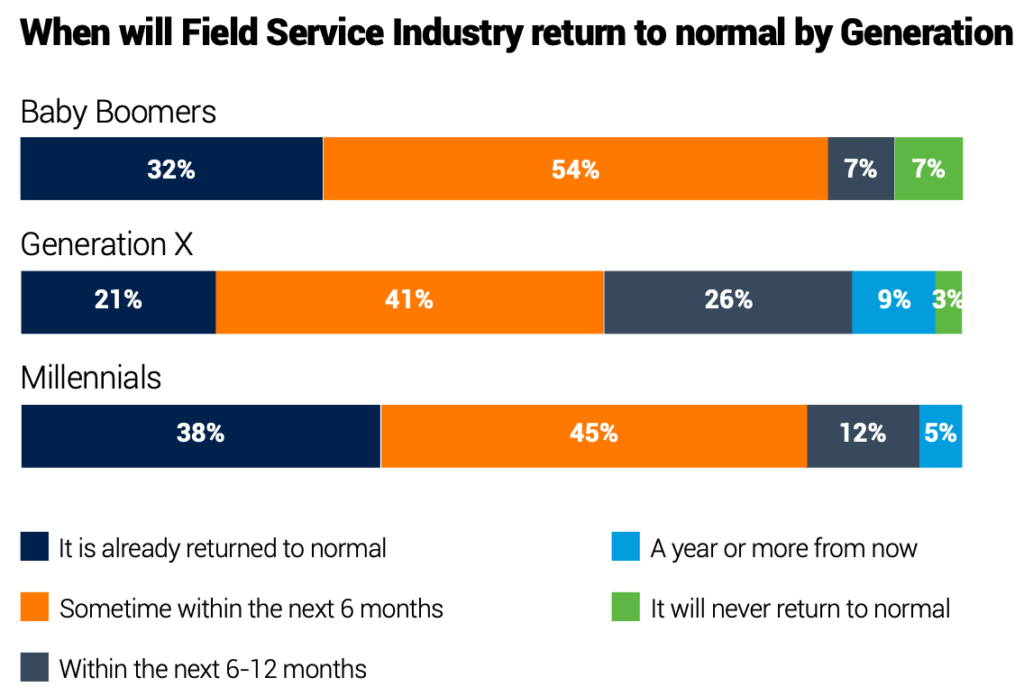

There are slightly different opinions about the industry’s future growth outlook by generation, by position, and by type of business. A plurality of respondents from the various generations believes the industry will return to normal within the next six months. About one third of Baby Boomers (38%) and Millennials (32%) believe the industry has already returned to normal.

Most of the TPMs/ISOs (56%), Distributors/Resellers (48%), and Contractors/Installers (79%) share the view that the industry will return to normal in the next six months. However, nearly half (46%) of the manufacturers believe it has returned to normal. Perhaps this is because manufacturers have more visibility and control over market trends.

Interestingly, most (77%) of the C-Suite executives surveyed believe it will return to normal within the next six months. While VPs/Directors (38%) and Board Members/Owners/ Presidents believe it has already returned to normal. Each of the cohort’s control over their operations may drive this perspective into business trends and forecasts.

Field Service Software: Augmented Reality (AR) Adoption

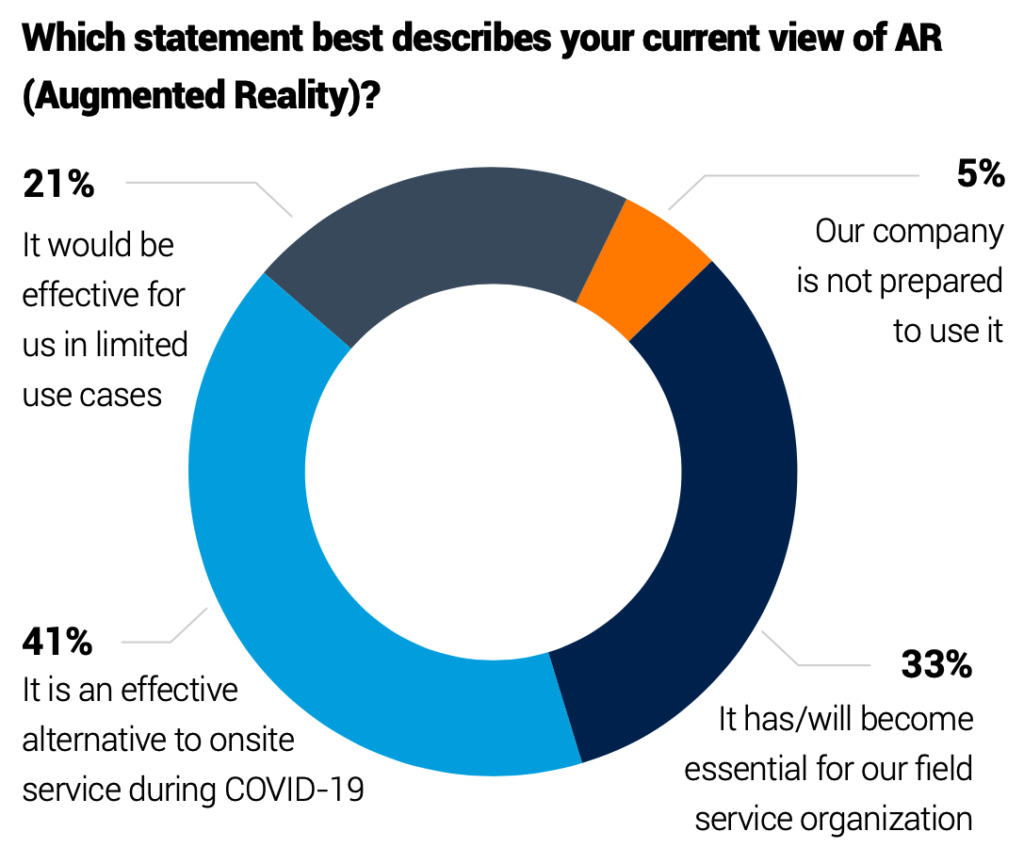

During the pandemic, many Field Service Organizations (FSOs) implemented an Augmented Reality (AR) enabled Remote Visual Assistance Software solution. This allowed them to deliver a “Contactless Service” or “Touchless Service” experience to their customers. From analysts and consultants to software vendors and field service executives, many industry participants have developed informed opinions regarding their view of AR. Although most (41%) of the respondents surveyed agree that AR is an effective alternative to onsite service during Covid-19, one-third (33%) indicate that AR has become essential for their organization (see figure 6). Another 21% support the notion that AR is effective in a limited or selected number of use cases.

These are encouraging data points for proponents of AR and touchless service. It affirms that this technology is not only a temporary fix to an acute problem. It also serves as a valuable tool for achieving transformational change within a field service organization. For example, the technology enhances remote support effectiveness and eliminates truck rolls. It can also generate new sources of revenue from the delivery of an improved service experience. An overwhelming majority of respondents (84%) either somewhat agree (43%) or strongly agree (41%) that AR will have a positive impact on the future of field service.

The Most Compelling Use Case For Augmented Reality (AR)

Survey respondents also provided their opinion on the most compelling use case for AR. Approximately three- quarters (74%) indicated that the strongest use case is that AR facilitates remote customer support/resolution. Over two-thirds (68%) suggest that providing remote support to field service engineers is the strongest use case for this technology. Fostering more efficient equipment installation and inspection (42%), training (42%), and returns and warranty management (12%) also received frequent mention.

The Critical Benefits of AR

Perhaps these comments from survey respondents help shed light on what FSOs perceive to be a few of the critical benefits of AR:

“An effective way to deal with the labor supply and demand challenges that will get to critical levels. Especially as more baby boomers leave the workforce and create and massive experience and knowledge gap.”

“It can help us solve problems and work in a more three-dimensional way.”

“There is no need for a face-to-face explanation so that customers can see it more intuitively.”

“It leads to fewer truck rolls, quicker customer uptime.“

Indeed, these findings validate a view that AR-enabled Remote Visual Assistance solutions have a broad set of uses cases. More importantly, it supports an opinion that AR has a critical application within an FSO tool kit. Just like mobile computing and field service management software, using AR in various field service activities will become table stakes for FSOs.

You can download and read the entire sentiment study which will provide you access to the full set of findings.

These Include Additional Data And Findings Such As:

- Interest in customer self service models

- Thoughts on the technology adoption lifecycle

- Factors driving technology adoption

- Influencers on technology acquisition decisions

- Outlook on the field service labor market

- Hiring expectations in field service

- Impact of technology on labor shortages

- Views on the primary role of service teams

- Influence of service teams within companies

- Future outlook for service organizations

Conclusions: Role Of Field Service Software And More

There is a great deal of optimism among industry participants that the field service industry is now recovering from the terrible shock waves of Covid-19.

A large percentage of field service leaders believe their service businesses have returned to normal or will within the next six months. There is some difference of opinion regarding the pace of recovery by generation, type of business, and people’s position or role within their company. These differences reflect the values and aspirations of different cohort groups. It also reflects the visibility and control each cohort group has in driving change within their organizations.

Companies Turn To Augmented Reality

Many companies turned to augmented reality enabled Remote Visual Assistance software to provide a contactless or touchless service experience during the pandemic. Many field service leaders view it as an effective tool to overcome obstacles to delivering onsite service during the pandemic. A significant number believe it has become an essential tool for providing field service regardless. It is likely to become a critical tool in facilitating a company‘s customer support and remote resolution objectives.

Trend Toward Customer Self Service

The trend toward customer self-service began many years ago. However, Covid-19 and the proliferation of technologies like AR, AI, and IoT have significantly accelerated the speed at which customer self-service will become pervasive within the industry. Among the different technologies available to FSOs, AI & Machine Learning are the most advanced in terms of adoption rates. This is primarily due to their applicability in multiple areas beyond field service. For example, to anticipate or avoid equipment failures or to optimize parts inventory stocking levels, or field service engineer schedules and staffing levels. However, AR and IoT will likely experience more growth as companies seek to reap the benefits these technologies provide.

Available Labor – Replacing An Aging Workforce

As the industry returns to normal, FSOs will need to continue to deal with the same issues they faced before the pandemic. One of these issues is finding available labor to replace an aging workforce. Utilizing a blended workforce model and relying on technology like AR, IoT, and AI is a way to upskill and attract newer workers. Fortunately, there is a great deal of optimism within the industry that this new labor exists. However, many leaders are concerned about finding qualified candidates.

Primary Role Of The Service Organization

With sights on the future, it is essential to recognize that most companies believe that the primary role of the service organization should be to ensure that products operate properly or influence product sales and add value. These findings suggest that the FSO plays an operational or tactical role in most companies. Companies that expect to generate a more significant portion of their revenues and profits from service must allow their FSOs to play a more strategic role. This includes developing income directly from service and gaining market control from innovative solutions.

It is encouraging that the FSO has input into the product strategy at many companies instead of just executing on the strategy once established. Over time, it is assumed that FSOs will play an equal role in setting the strategy. It may even be necessary for FSOs to drive strategy as their companies migrate towards outcome-based business models. Nevertheless, the field service industry has a reason to be exuberant about the future. Service businesses are in hyper growth and driving transformation in many companies.

To get all the insights, download the 2021 field service industry sentiment study.